But other private lenders offer borrowers opportunities to get an additional 025 to 050 interest rate discount by. Borrowing up to 100 of all school-certified expenses.

Edvisors Financial Aid Student Loans And College Scholarships

Edvisors Financial Aid Student Loans And College Scholarships

Sallie Mae offers personal loans ranging from 3000 to 35000.

How much can i borrow from sallie mae. APRs for the Principal and Interest Repayment Option may be higher than APRs for the Interest Repayment Option. As an incentive for prompt and consistent repayment Sallie Mae also offers a 025 interest rate deduction for those who use an automatic debit payment on their loan. Fixed Interest Rates Starting At.

Does Sallie Mae Student Loans charge prepayment fees. Whenever possible go with lenders that dont charge origination fees. - Source RBS Citizens 37000 is not dischargeable but will be repaid at 0 interest and at 75 per month until the 37000 has been paid.

If tuition was 18K most likely your total COA would be at least 30K. Smart Option Student Loan Variable Interest Rates Starting At. Payments can be made online on our mobile application by mail or you can call us at 888-295-3447.

They can cosign a Smart Option Student Loan or take out a Sallie Mae Parent Loan in their own name. Sallie Mae offers annual percentage interest rates between 574 and 1185 for a fixed rate loan and between 225 and 937 for a variable rate loan. Typically fees range from 05 to 5 of the loan amount.

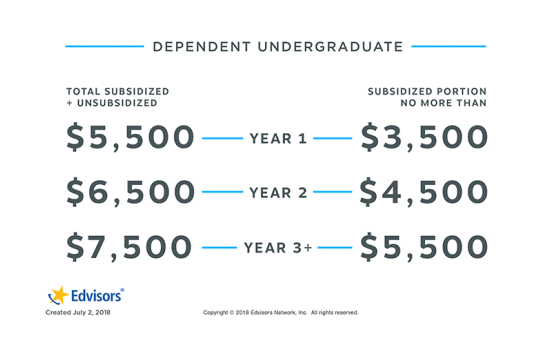

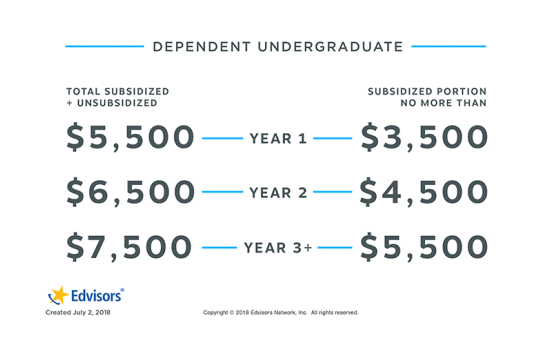

Sallie Mae will let you borrow the max of your federal loan award Stafford. Then youll be left with the amount you still need to. You cannot take out more than the estimated COA unless you get approval from the finanical aid office.

Basically Sallie Mae can lend out money to 5 people and have 3 people stop payingand still make money a 1 profit. These loans range from 3000 to 35000 and come with fixed rates from 275 to 1075 APR. Sallie Mae Parent Loans have variable rates that start from 337 APR to 1299 APR and fixed rates from 549 APR to 1387 APR.

For that and private loans they check your credit rating for these they check with the school and certify you to get up to the total cost of your education minus any other financial. You can think about it this way too. When applying for an undergraduate student loan youll need to decide things like how much money to borrow for college how youd like to pay the money back.

425 1259 APR with auto-debit. Make check payable to Sallie Mae and please put your account number on your check Sallie Mae PO Box 70233. Sallie Mae also offers personal loans on an invitation-only basis.

Variable rates may increase over the life of the loan. No Sallie Mae Student Loans does not charge a loan origination fee. Drawbacks of Sallie Mae Student Loans.

Sallie Mae owed 94140 and reduces debt to 60000 at 3 interest payable at 28453 for 300 months. Get ready to borrow. Sallie Mae can cover up to 100 percent of your school-certified costs of attendance and you may be able to take advantage of extra benefits like four months of free Chegg study help.

The reason Sallie Mae has allowed you to take out more is because you are not at the total cost of attendance COA. No origination fee at the start of your loan. Sallie Mae offers many easy ways to let you make a payment on your account.

For that and private loans they check your credit rating for these they check with the school and certify you to get. Parents can help their students pay for college in two ways. Say this student stops paying their debt.

To qualify you must first receive an offer code in the mail or by email. No additional interest rate discount. Sallie Maes undergrad loans provide.

Room and board transportation tuition books and any fees go into the estimated COA. Instead of earning 4 the company is now losing 1. Sallie Mae will let you borrow the max of your federal loan award Stafford.

Its also helpful to understand whats required during the application process and what happens after your. All of Sallie Maes loans also give borrowers and cosigners quarterly access to a FICO credit score. 125 1135 APR with auto-debit.

Subtract any money you have received from scholarships grants work-study and federal loans along with any savings you or your family have for school. These are separate loans with different features and interest rates so parents should compare their loan options. Thats because it only takes one person to cover the obligations for the other 3 people before losing money.

Borrow only for the cost of tuition and related expenses. Its important to understand how private student loans work and how the decisions you make now can affect your future. Sallie Mae Personal Loans Pros Cons Thats a reasonable range that will let you borrow the right amount for most needs.

Sallie Maes 025 interest rate discount for auto debit is standard for most federal and private student loans. 025 interest rate reduction if you enroll with auto-debit. A loan origination fee is what some lenders charge for processing underwriting and funding a loan.

Halaman

Monash

Labels

-

The production of speech sound is the main type of phonetics and it is known as articulatory phonetics. In the case of oral languages phone...

-

The less-used punctuation symbols are virgule underline ellipsis points square brackets etc. The Well-Known Punctuation Errors to Know Befo...

-

Only the nursing regulatory body to which you applied can release your official results which will be sent to you approximately six weeks a...

-

If certain topics names or concepts appear more than once underline or highlight them and make sure they are prominent in your study guide....

-

When a degree is considered terminal it means that it is the highest degree awarded in a given field. A degree that helps you to reach the ...